Last month, the House and Senate came together to pass the American Rescue Plan Act, a $1.9 trillion stimulus bill that was signed into law by President Biden days later. Featuring a wide range of spending initiatives ranging from the direct payments to Americans making less than $70,000 to money for schools, infrastructure, and agriculture, the bill also focused on making health insurance more affordable and accessible.

Enhanced Premium Subsidies + Special Enrollment Period: Can You Upgrade Insurance?

As we discussed in a blog on the topic, the bill expanded tax credits for premiums and offered reimbursement for COBRA Premiums if an individual was to lose his or her job. Paired with this, the law extended the Special Enrollment Period.

Initially supposed to last from Monday, February 15 to Saturday, May 15, the new law extends the time to enroll three more months to August 15, 2021. But what does this mean if you’re already insured through the Marketplace? Well, when combined with the ACA expansion provided by the stimulus law and the freedom to change plans during a Special Enrollment Period, you may be able to secure better insurance at a lower cost.

Enhanced Premium Subsidies in 2021 and 2022

These two provisions—an extension of the Special Enrollment Period and the temporary expansion of ACA benefits—create not only an opportunity for the uninsured, but also for those currently enrolled in Marketplace Plans.

- Uninsured individuals will have a new opportunity to enroll in Marketplace Coverage, something usually available only during Open Enrollment.

- Those currently enrolled in a Marketplace Plan now have the opportunity to get better coverage at a lower cost.

How Special Enrollment Periods Work

Special Enrollment Periods allow health insurance consumers to enroll in insurance outside of Open Enrollment. But with the new law, those enrolled may also be able to update their information and change plans, similar to the process of enrolling in a new plan during Enrollment. According to Healthcare.gov,

“You can change Marketplace health coverage through August 15 due to the coronavirus disease 2019 (COVID-19) emergency. If you’re currently enrolled in Marketplace coverage, you may qualify for more tax credits.”

Why Does This Matter?

Why is this a big deal? Simple—a lot of people selected a Bronze of Catastrophic plan because anything higher on the metal tier list was unaffordable. Premium credits start at silver-level plans, but once a person exceeded 400% of the Federal Poverty Level ($51,040 for one person or $104,800 for a family of four), the price starts to skyrocket.

When initially passed, the Affordable Care Act largely ignored the Middle Class. Worse, after significant wage growth for the Middle Class in the late 2010s, many people found themselves out-earning the 400% limit.

Why Should You Reevaluate Your Insurance?

Now, with expanded premium subsidies, everyone benefits from the changes, according to Kaiser Health News. For example, before this, an older customer not yet eligible for Medicare making $1 more than the $51,040 limit would end up paying 20% to 30% of their income toward their health care premium. The new law caps this at 8.5%.

Similarly, those making incomes up to 150% of the poverty level ($19,140), who would be required to pay 4.14% of income will end up owing nothing in premiums.

How to Find Out If You’re Eligible for Subsidies

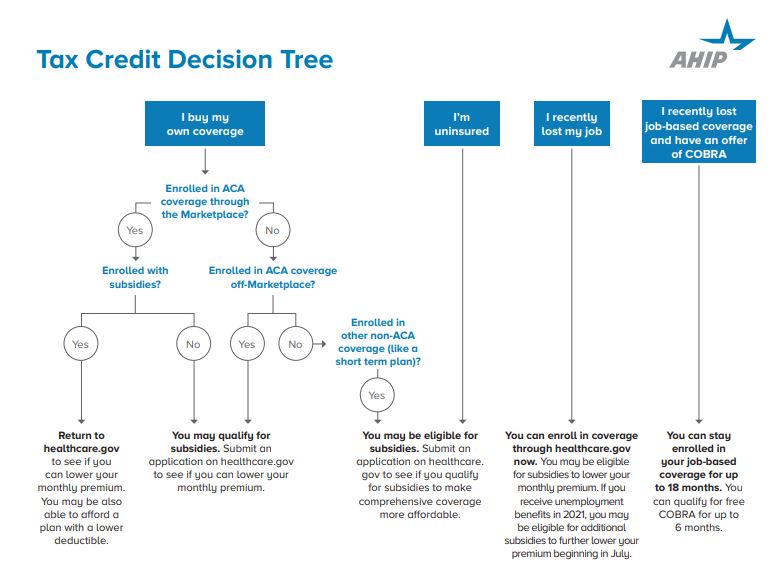

No matter where you stand, Kaiser Health News recommends taking another look at your insurance—and a flowchart from America’s Health Insurance Plans can help you figure out if you’re eligible:

Steps to Take Today

Depending on where you stand, Kaiser Health News recommends you evaluate your current standing to see if you can upgrade:

- If you have marketplace coverage in one of the 36 states that use the federal healthcare.gov platform: Update your application and reselect your current plan to get new details about your subsidies.

- If you have marketplace coverage through a state that runs its own marketplace: Check the current procedures for your state. Certain places including California, D.C. and Rhode Island have already announced that enrollees premiums will be adjusted automatically.

- If you were already eligible for a premium subsidy: After checking your new status, plan to claim premium tax credits paid from January through April on Taxes next year.

- If you are on an off-marketplace plan: Consider enrolling in a marketplace plan, especially if you went off-marketplace because your income was too high to qualify for tax credits.

- If you made too much to qualify for tax credits and are on a Bronze Plan: Consider switching to better coverage with lower cost sharing for the same contribution. Beware of the drawback below.

Are There Drawbacks? At Least One.

As the Special Enrollment Period allows you to change plans—enrolling in a new plan will come with a new deductible. If you’ve already received a lot of care in the past four months and are coming close to reaching or exceeding your deductible, it may be in your best interest to avoid making a change. According to Healthcare.gov,

“If you change plans or add a new household member, any out-of-pocket costs you already paid on your current 2021 Marketplace plan probably won’t count towards your new deductible, even if you stay with the same insurance company. […]

If you have already paid a lot in out-of-pocket costs toward your deductible, check with your insurance company to see how it might impact you and what options are available to keep credit toward what you’ve already paid.”

It Pays to Review Your Options: Talk with a Broker Today

Whether you’re uninsured or feel that the plan you chose during Open Enrollment isn’t providing you what you expected, now is the chance to make it right.

The best way to get a plan that works for you is to speak with a broker. Brokers work for you to give you the right information about your options and understand the nuances of each plan available to you. How can you work with a broker? Look no further than our free service, Insurance Broker Hub.

Our free service gives you access to an independent network of national brokers who have the experience and expertise to design a plan around your needs and budget. Ready to get started? Simply request a no obligation health insurance quote here.