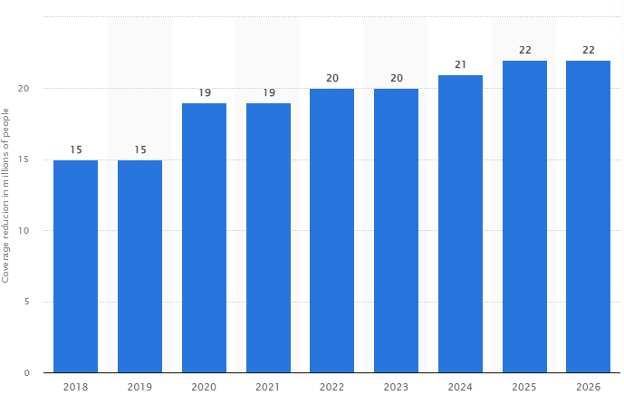

Losing your health insurance can be a daunting experience, to say the least., but it’s essential to know that you have options available to secure coverage quickly. Statistics report that by 2026, about 22 million people will likely lose their health coverage due to the Senate health bill in the US.

In the United States, health insurance is often tied to employment, and when you lose your job-related health insurance, it’s crucial to take prompt action to maintain coverage for yourself and your family.

In this article, we’ll guide you through the steps you need to take and provide valuable information on how to navigate this challenging situation. Plus, we’ll highlight how using a health insurance broker can streamline the process, save you money, and ensure you get the best coverage available.

Key Statistics:

- Time-Sensitive Decisions: Many options for new health insurance coverage have time-limited deadlines, typically ranging from 30 to 60 days from the loss of your previous coverage. Acting promptly is essential to secure the coverage you need.

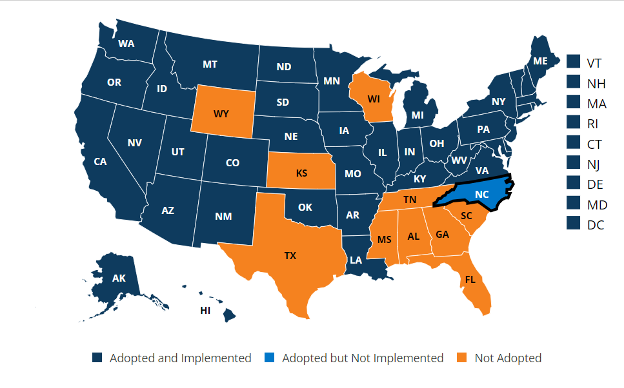

- Medicaid Eligibility: Medicaid, a joint federal and state program for low-income individuals, is a significant health insurer in the United States. In 40 states that have accepted Medicaid expansion, you can qualify if you earn 138% of the poverty level. However, eligibility varies by state. So far, only 10 states remain that have not implemented this, while North Carolina has adopted it, but hasn’t implemented yet.

- COBRA Coverage: COBRA (Consolidated Omnibus Budget Reconciliation Act) allows you to continue on your employer’s group insurance plan for a limited period after job loss, but you must elect this coverage within 60 days of losing insurance.

So, What To Do Now?

1. Purchase Marketplace Coverage

When you lose job-related health insurance, you can typically qualify for a special enrollment period that extends for 60 days from the loss of your job and insurance. This special enrollment period allows you to purchase an Affordable Care Act (ACA) policy through the HealthCare.gov Marketplace.

Here’s what you need to do:

- Gather the necessary documents, such as a letter from your employer or insurance company confirming the loss of coverage.

- Once qualified for special enrollment, visit healthcare.gov to explore health insurance options in your ZIP code.

- Compare prices, coverage options, and star ratings to find a plan that suits your needs and budget.

Utilizing a health insurance broker like Insurance Broker Hub can simplify this process significantly. A broker can help you navigate the available plans, understand the subsidies you may be eligible for, and find the best policy to meet your specific needs.

2. Join A Family Member’s Policy

If your spouse or parents have a health insurance policy, you may be able to join it within 30 days (some employers may offer a longer period) after losing your insurance coverage. While this may result in additional premium costs for your family member, it is often a cost-effective option for obtaining replacement coverage quickly.

It is important that you consult your provider or a health insurance broker for assistance in evaluating whether joining a family member’s policy is the right choice for you, considering factors like cost and coverage.

3. Sign Up for Medicaid

Medicaid is a significant health insurance program for low-income individuals in the United States. Eligibility for Medicaid varies by state, with some states having higher income limits and broader criteria than others.

For many states, low income alone is a qualifier for Medicaid, making it an accessible and cost-effective option for individuals facing job-related insurance loss. However, eligibility requirements can vary, so it’s essential to confirm your status with your state’s Medicaid program.

A health insurance broker can provide valuable insights into Medicaid eligibility and assist you in navigating the application process.

4. Get COBRA Health Coverage

COBRA (Consolidated Omnibus Budget Reconciliation Act) allows individuals who have lost their job-related health insurance to continue their coverage for up to 18 months. You must elect COBRA coverage within 60 days of losing your insurance.

While COBRA offers the advantage of allowing you to stay with your current doctors for ongoing treatment, it can be relatively expensive. Premiums cannot exceed 102% of the plan’s cost, and you may be responsible for both your and your employer’s share of the premiums.

To determine if COBRA is the right choice for you or explore more cost-effective alternatives, consider consulting with a health insurance broker. They can help you weigh the pros and cons and find a solution that aligns with your needs and budget.

5. Buy Short-Term Health Insurance

Short-term health insurance can be an option if you’re unable to secure coverage through a special enrollment period or other means. These policies are typically sold by insurance companies and brokers in states where they are permitted.

Here’s what to keep in mind:

- Short-term policies may not offer the same level of coverage as ACA-compliant plans and often exclude pre-existing conditions.

- Premiums for short-term insurance may be based on your medical history, and applicants can be denied coverage.

- These policies are generally less expensive than traditional health plans and can be kept for up to a year.

However, it’s crucial to understand the limitations and exclusions of short-term health insurance. Consulting with a health insurance broker can help you navigate the complexities of these policies and determine if they are a suitable temporary solution for your needs.

If You Have Lost Your Job-Related Health Insurance, Contact Insurance Broker Hub ASAP

Losing your job-related health insurance can be a stressful experience, but knowing your options and taking timely action can help you maintain coverage and protect your health and financial well-being. Utilizing the services of a health insurance broker can make this process more manageable, save you money, and ensure you select the best health insurance plan for your unique circumstances.

In times of uncertainty, having access to expert guidance can be invaluable. Get a free health insurance quote from Insurance Broker Hub to get personalized assistance in securing the coverage you need and making informed decisions about your health insurance options. Remember, with the right support, you can navigate this challenging situation and find the health insurance solution that works best for you and your family.