Health insurance is a vital aspect of safeguarding one’s well-being and financial security. As we age, a common question that arises is how age affects health insurance premiums. At the same time, the significance of health insurance becomes even more pronounced.

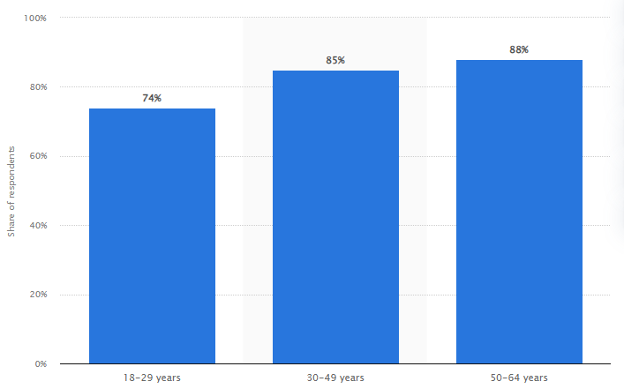

In 2022, old age health insurance was the most prominent one, with more than 88% of people aged 50-64 years having a health insurance plan. This is mostly because of the potential for increased healthcare needs at this age range.

The interplay between age and health insurance premiums is a subject of interest for many policyholders. In this article, we will delve into how age affects health insurance premiums. shedding light on the complex relationship between the two.

Impact of Age on Health Insurance Premiums

Age plays a significant role in determining health insurance premiums. Insurance providers consider age as a crucial factor when assessing risk, as certain health conditions tend to become more prevalent with advancing years. Younger individuals typically present lower health risks. This results in comparatively lower premiums.

However, as age increases, the likelihood of medical issues arising grows, leading to adjustments in premium rates to reflect the elevated risks. That is why old-age health insurance slabs are often higher than those of lower age.

According to a study conducted by the National Association of Insurance Commissioners, individuals between the ages of 18 and 24 pay an average monthly premium of $176. On the other hand, those aged 45 to 54 experience an increase of up to $361 per month.

Furthermore, the age group of 55 to 64 sees an even more substantial rise. It sees an average monthly premium of $543.

State Variations in Health Insurance Premiums Based on Age

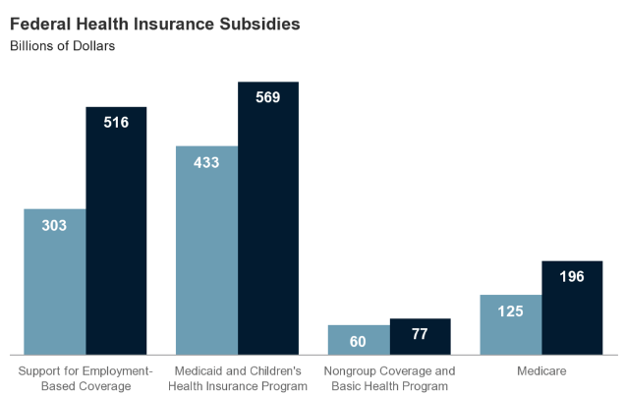

While the federal government provides subsidies for health insurance coverage for people under the age of 65. This way, it establishes guidelines for health insurance premiums based on age. However, some states have taken their own approach.

Source: Congressional Budget Office

They have set unique rules that can affect how premiums are determined. These state exceptions aim to promote fairness and accessibility in healthcare coverage, but they can also lead to different cost structures for policyholders.

Here are some notable examples:

- New York & Vermont: In these states, age is not considered a factor when determining health insurance rates. As a result, premiums do not vary based on age across the board.

- Alabama, Mississippi, & Oregon: While the federal rule applies to individuals aged 21 and older, these states set a different standard for those under 21. Policyholders under 21 pay a premium that is set at 63.5% of the base rate.

- Massachusetts: Massachusetts adopts its own rating rules for all age groups. For example, individuals between ages 21 and 24 pay 118% of the base rate, while those aged 49 and above have a lower age ratio compared to the federal standard. The goal is to strike a balance between cost considerations and age-related risk factors.

- Minnesota: Minnesota uses a consistent 89% of the base rate for all policyholders under 21, regardless of the federal variation.

- Utah: In Utah, the federal rule applies to individuals aged 64 and older. However, those between the ages of 27 and 36 pay nearly 140% more than the base rate.

- Washington, D.C.: Here, individuals aged 64 and older pay only two times the base rate instead of the federal three times.

These state exceptions highlight the significance of reviewing state-specific rules to gain a comprehensive understanding of premium structures and to make informed decisions about healthcare coverage.

Simplifying Health Insurance with Insurance Broker Hub

Navigating the intricate world of health insurance can be a daunting task, especially when trying to comprehend how age affects health insurance premiums on your own. This is where Insurance Broker Hub comes to the rescue. With their expert guidance and personalized assistance, finding the perfect health insurance plan becomes a breeze.

Insurance Broker Hub helps you decipher the intricacies of health insurance, especially in light of how age affects premiums. Our personalized approach, coupled with a deep understanding of the health insurance landscape, empowers you to make well-informed decisions. We help you save time, money, and unnecessary stress.

With our expert assistance, you can embark on your health insurance journey with confidence, knowing that your coverage is tailored to your age, healthcare needs, and financial well-being. Request a free health insurance quote today and experience the peace of mind that comes with having the best health insurance plan for your unique situation!

Additional Health Insurance Resources

How to Lower My Health Insurance Premium

How Is Your Health Insurance Premium Spent?

How to Save Money on Health Insurance: Tips for Finding Affordable Coverage