Are you prepared for unexpected hospital bills? The average cost of a three-day hospital stay in the US is a staggering $30,000. Even with health insurance or off-marketplace options, out-of-pocket expenses can lead to financial turmoil and a lot of stress for you and your family.

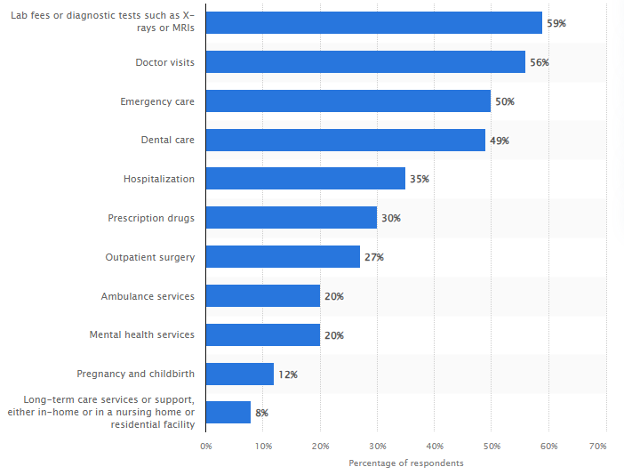

In fact, medical debt is one of the leading causes of bankruptcy, with the median medical debt in the US being $2,000. In 2022, one of the most prominent source (59%) of this debt among adults were related to lab fees or diagnostic tests. These may include X-Rays, MRIs, CT Scans, ECGs, or simple bloodwork.

If you’re anxious about the financial implications of a hospital stay, it’s time to explore hospital indemnity insurance. In this guide, we’ll cover everything you need to know about this supplemental insurance and how it can safeguard your financial well-being.

Understanding Hospital Indemnity Insurance

Hospital indemnity insurance is a supplemental plan designed to provide you with a financial safety net in the event of a hospitalization. While your regular health insurance covers medical expenses, hospital indemnity insurance offers you a fixed benefit amount.

This helps cover other costs associated with your hospital stay. These benefits can be used for deductibles, transportation, or even everyday expenses like groceries and childcare during your recovery.

Unlike health insurance, which pays healthcare providers directly, hospital indemnity insurance pays you directly – as the policyholder. This gives you the flexibility to allocate the funds where they are needed most.

Indemnity Coverage Details

Hospital indemnity insurance covers a range of circumstances related to hospitalization or specific healthcare services. It doesn’t have deductibles, coinsurance, copays, or network restrictions, providing you with more flexibility in how you use the benefits.

Typical covered circumstances include:

- Hospitalizations

- Intensive care

- Critical care

Some policies may also extend coverage to:

- Outpatient surgery

- Ambulance services

- Emergency room (ER) visits

It’s worth noting that many hospital indemnity insurance policies also offer coverage for your spouse and family, providing additional peace of mind.

What Is NOT Covered With Hospital Indemnity Insurance?

It’s important to understand that hospital indemnity insurance is not a substitute for regular health insurance. It doesn’t cover routine doctor visits, preventive care, or diagnostic tests. Instead, it’s designed to provide financial assistance for more serious issues, such as admittance, surgeries, or hospitalizations.

These policies also have limits, depending on the provider. These include, but may not be limited to:

- Hospital daily benefits (a set dollar amount per day)

- A maximum limit on the total number of days covered

- Intensive care unit benefits (often a percentage of the daily benefit)

- Benefit reductions at a certain age (usually around 70)

Where to Purchase Hospital Indemnity Insurance

Hospital indemnity insurance is offered by several insurance companies, often through employers. Some insurers also allow individuals to purchase coverage directly.

However, before you make a decision to call an insurance company, it is important that you also have someone to back you up. This includes someone who will always look out for your interests, especially when it comes to the cost benefits and coverage you get. That’s where insurance brokers such as Insurance Broker Hub come in.

Who Should Consider Hospital Indemnity Insurance?

Hospital indemnity insurance can be a valuable addition to your financial safety net if you fall into any of the following categories:

- You have a chronic condition that could lead to hospitalization.

- You’re planning a procedure or surgery that may require a hospital stay.

- You’re expecting a child, and coverage could help with post-childbirth hospital stays.

- You want extra coverage for accidents and unforeseen events.

- You have a high-deductible health insurance plan with significant out-of-pocket costs.

- You anticipate needing out-of-network care and want assistance with those costs.

- You want peace of mind for worst-case scenarios.

Cost of Hospital Indemnity Insurance

The cost of hospital indemnity insurance can vary depending on several factors. These may include:

- Your age,

- Location,

- Deductible (if applicable),

- Insurance company,

- Any pre-existing condition, and

- Coverage amount.

Keep in mind that premiums for hospital indemnity insurance tend to be lower for younger individuals. Additionally, the daily benefit limit you choose will affect your premium.

Key Considerations When Buying Hospital Indemnity Insurance

Before purchasing hospital indemnity insurance, there are several factors to consider. The most prominent of these include:

- Payment Time: Understand how long it takes for the insurance company to make a payout after a covered hospitalization.

- Length of Coverage: Hospital indemnity insurance plans specify the number of days of coverage. Be aware of this when selecting a plan.

- Individual or Family Coverage: Determine whether you need coverage for yourself, your spouse, and your children.

- Age Restrictions: Some insurance companies impose age restrictions on who can purchase hospital indemnity insurance.

Getting Hospital Indemnity Insurance

Getting your hospital indemnity insurance is a straightforward process. You can consult a licensed insurance broker, like Insurance Broker Hub, or shop online to find a plan that suits your needs. Unlike health insurance, there’s no marketplace for hospital indemnity insurance.

Start by checking with your current health insurance provider to see if they offer hospital indemnity coverage. If not, explore insurance companies or insurance brokerages that provide this type of benefit alongside other insurance plans.

Once you’ve selected a plan, using your benefits is as simple as submitting a claim form after receiving qualified medical care.

Final Words: Should You Go For Hospital Indemnity Insurance?

Hospital indemnity insurance serves as a valuable financial safety net, particularly if you’re worried about potential healthcare costs or if you have a high-deductible health plan. It can also be beneficial if you expect to incur out-of-network charges, have significant out-of-pocket expenses, or are about to enter a special enrollment period, such as getting married.

However, it’s essential to remember that hospital indemnity insurance is not a replacement for comprehensive health insurance. It is a supplemental plan designed to provide additional financial assistance. Before making a decision, carefully consider your specific healthcare needs and budget to determine if hospital indemnity insurance is right for you. For assistance, request a free health insurance quote from Insurance Broker Hub. We do the legwork, shopping, and research to find the plan that is tailored to your budget and needs.